By: Liz Ann Sonders, Kathy Jones, Jeffrey Kleintop of Charles Schwab.

Economic data has provided encouragement for both stock market bulls and bears.

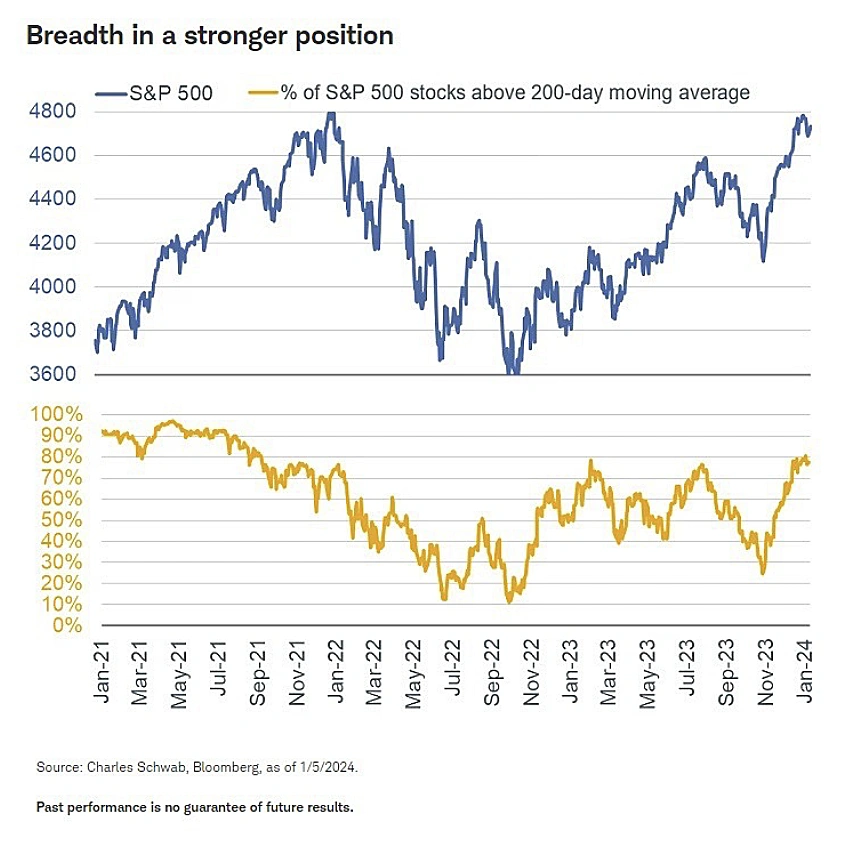

Economic data continues to provide evidence to satisfy both optimists and pessimists. Even if stocks look relatively expensive and investor sentiment seems to have become more exuberant (which tends to be a contrarian signal) since the recent low in October, the good news is that market breadth is in a healthier position as 2024 begins.

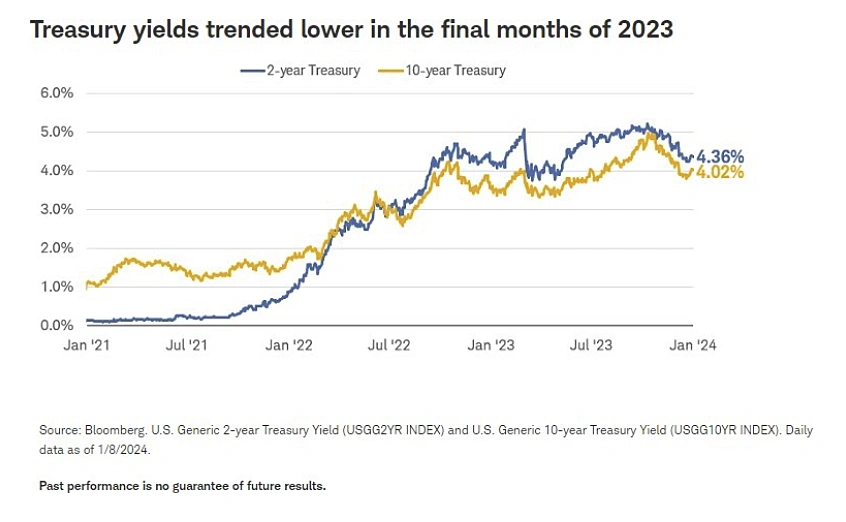

As inflation continues to recede, we expect Treasury yields to continue to trend lower. The prospect of interest rate cuts by the Federal Reserve should be positive for the bond market, although we expect volatility to remain elevated. Meanwhile, a new European fiscal agreement may help some countries emerge from recession unimpeded by the harsh fiscal adjustments that would have been required under the old rules.

U.S. stocks and economy: This or that?

As has been the case for most of the post-pandemic period, economic data points have had enough to satisfy optimists’ and pessimists’ biases. Labor market data—in particular, the monthly jobs reports—have perhaps been the best examples of providing enough evidence for both the economic bulls and bears.

For instance, December’s jobs report looked great on the surface—with 216,000 jobs created, an unchanged unemployment rate, and still-strong earnings growth. Yet, revisions resulted in 71,000 fewer payrolls in October and November; the unemployment rate was unchanged because of the decline in the labor force; and household employment fell by nearly 700,000 individuals.

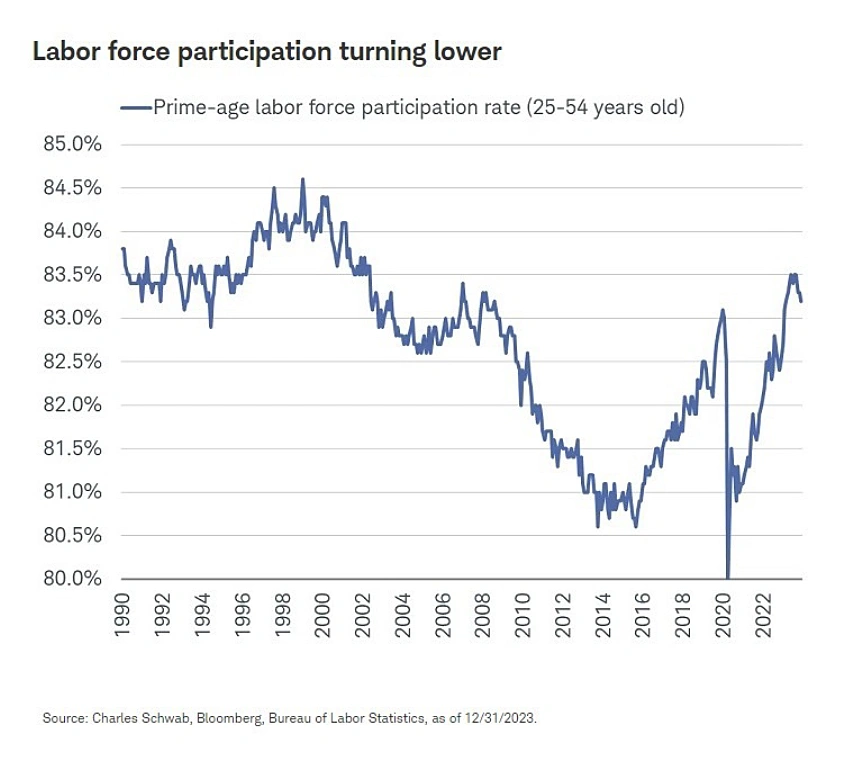

To be sure, there are still several labor data that look relatively strong in level terms. As shown in the chart below, the prime-age labor force participation rate is at a healthy level relative to its plunge during the pandemic. However, rates of change matter more at potential economic inflection points. As such, investors should pay attention to the renewed downturn over the past few months. If it continues, it would signal increasing weakness in labor supply.

Any dent to labor supply would likely complicate the Federal Reserve’s inflation fight, especially because wage growth is still running at a relatively brisk pace. That isn’t to say a sudden resurgence in inflation is imminent, but it underscores the risk of a more volatile inflation environment moving forward.

All else being equal, more volatile inflation tends to coincide with stress for more richly valued parts of the stock market, and in turn means that price-to-earnings (P/E) multiples might face added pressure moving forward. As you can see in the chart below, the S&P 500’s forward P/E has climbed substantially over the past year; save for some extreme periods in the late-1990s and early-2020s, the market looks quite expensive.

While that does present some risk to the market in terms of how expensive it looks, we’d emphasize to investors that valuation is truly in the eye of the beholder. Not only can investors adjust the “E” they use in the P/E ratio (forward or trailing earnings growth); they can use other metrics to justify their market view— such as an equity risk premium or total market capitalization relative to gross domestic product (GDP).

Even if the market looks quite expensive and investor sentiment has seemingly gotten much frothier since the recent low in October, the good news is that market breadth is in a healthier position to start the year off. As shown in the chart below, the percentage of S&P 500 members trading above their 200-day moving average recently reached the 80% threshold, which is typically an encouraging sign of a sustainable advance.

That isn’t to say the upward trend will be devoid of selloffs. We continue to think volatility will stay elevated, especially as the market still looks to be ahead of the Fed in presuming rate cuts are approaching quickly.

Fixed income: What happened to “higher for longer”?

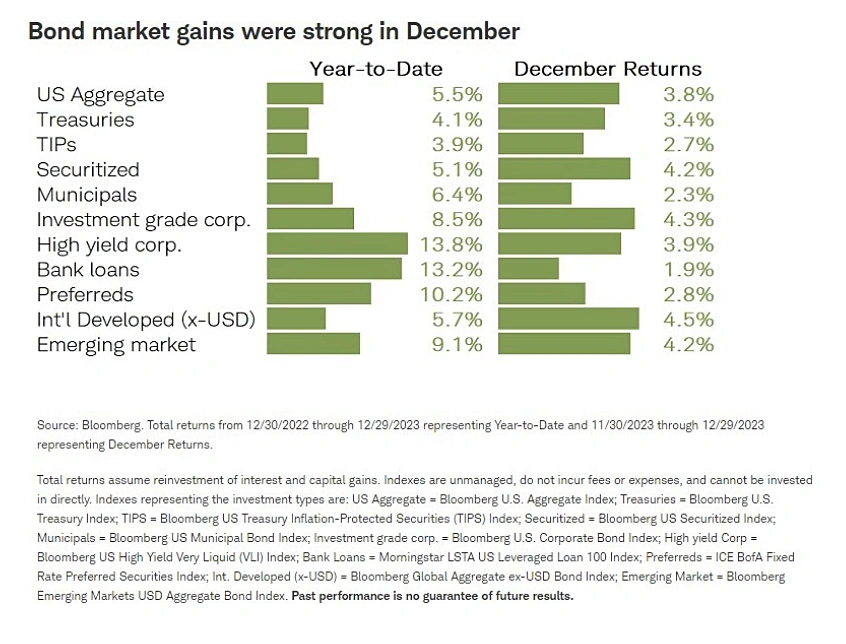

The bond market has started 2024 by giving back some of the gains seen in late 2023. That’s not too surprising, as the gains in December alone were sizable and contributed to much of the positive total return for the year.

Although some retracement in yields seems reasonable, we expect the overall trend in yields to continue lower. Declining inflation and the prospect of interest rate cuts by the Federal Reserve should be positive for the bond market, although we expect volatility to remain elevated.

The key factor driving the trend in interest rates has been falling inflation. The measure that the Federal Reserve uses for its benchmark of inflation—the core personal consumption expenditures index (core PCE), which excludes volatile food and energy prices, fell to a 3.2% year-to-year pace in December. It has been in a steady downtrend since reaching a 5.6% peak in February 2022. Moreover, the latest month-to-month readings have been tame, averaging just 0.2% over the past six months. If the trend were to continue, then the Fed’s 2% inflation target could be reached by the fall.

We expect the Fed to begin cutting interest rates in mid-year, probably at the May meeting of the Federal Open Market Committee (FOMC). The markets are currently pricing in a 50% probability of a rate cut at the March meeting, but we believe that is likely too early. The Fed needs to see a consistent downtrend in the inflation rate toward its target to be comfortable starting an easing cycle, especially since the economy has been resilient.

While the prospect of rate cuts is positive for the bond market, intermediate to long-term yields are already pricing in close to a full cycle of easing. With the yield curve steeply inverted, the market is already reflecting a series of rate cuts. Historically, the spread between the Fed’s policy rate—the federal funds rate—and 10-year Treasury yields has ranged widely from about -2.0% to nearly +4.0% with a median value of 1.3%. It is currently near the lower end of its broad range, signaling that there may not be much room for intermediate-term yields to fall until the Fed is well into its easing cycle.

Nonetheless, current yields on “core” bonds—Treasuries, investment-grade corporate and muni bonds— look attractive on a risk/reward basis in our view. Volatility is likely to be elevated due to uncertainty about the timing and magnitude of Fed rate cuts, but with yields currently in the 4% to 5% region for most higher- rated bonds, the prospect for returns looks positive in 2024.

Global stocks and economy: Debt deal

While a battle in Congress over the United States’ debt and deficit is set to heat up in early 2024, European Union (EU) member countries came to an agreement on their debt and deficit rules at the end of 2023.

Several major changes have been made, generally shifts away from rigid numerical targets that included requiring countries with a deficit greater than 3% of GDP to cut it to less than 3% the following year and toward a longer-term and more flexible goal of debt sustainability while supporting EU policy priorities in defense, digitization, and energy transition.

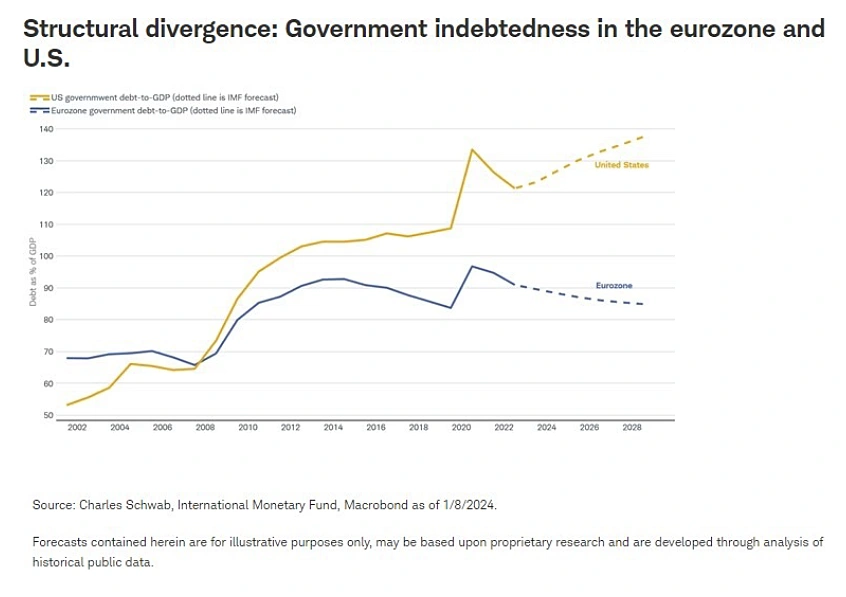

The new framework is intended to avoid damaging growth and to preserve Europe’s successful record of capping debt as a share of GDP. History suggests the EU’s fiscal rules have been a success over the past decade. This is a sharp contrast with the U.S., where the debt-to-GDP ratio has tended to increase even during periods of solid economic growth. With U.S. debt-to-GDP set to continue rising over the next five years and eurozone debt expected to fall, according to data tracked by the International Monetary Fund, it is becoming increasingly apparent that the debt outlook of the world’s largest developed economies has structurally diverged. We attribute this divergence partly to the EU’s fiscal framework.

There are several takeaways for 2024 related to the new fiscal agreement for Europe:

- Lower eurozone break-up risks. Any bargaining between eurozone member countries and the European Commission over fiscal adjustment paths may be more constructive. The new rules allow for a more flexible back-and-forth as well as include more realistic targets, likely making for smoother fiscal-adjustment negotiations.

- The political center holds. Polling suggests the European parliamentary elections in June 2024 may see the combined weight of the far-right parties in the European rise very modestly, leaving a centrist majority. This may result in more consistent industrial and trade policy.

- The eurozone economy may improve in 2024. Some members seem to be positioned to emerge from recession unimpeded by the harsh fiscal adjustments that would have been required under the old rules.

- Rate cuts may begin. The first rate cut by the European Central Bank is likely to take place in the first half of 2024 with the benefit of a clearer fiscal outlook.

- More military support expected for Ukraine. Despite opposition from Hungary in late 2023, it is expected that the EU will likely continue to scale up financial and military support for Ukraine in 2024, at the urging of German Chancellor Olaf Scholz.

The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision. All expressions of opinion are subject to change without notice in reaction to shifting market conditions.

Data contained herein from third-party providers is obtained from what are considered reliable sources. However, its accuracy, completeness, or reliability cannot be guaranteed. Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.

Past performance is no guarantee of future results, and the opinions presented cannot be viewed as an indicator of future performance.

Investing involves risk, including loss of principal.

Fixed income securities are subject to increased loss of principal during periods of rising interest rates. Fixed income investments are subject to various other risks including changes in credit quality, market valuations, liquidity, prepayments, early redemption, corporate events, tax ramifications, and other factors. Lower rated securities are subject to greater credit risk, default risk, and liquidity risk.

International investments involve additional risks, which include differences in financial accounting standards, currency fluctuations, geopolitical risk, foreign taxes and regulations, and the potential for illiquid markets. Investing in emerging markets may accentuate these risks.

Treasury Inflation Protected Securities (TIPS) are inflation-linked securities issued by the US Government whose principal value is adjusted periodically in accordance with the rise and fall in the inflation rate. Thus, the dividend amount payable is also impacted by variations in the inflation rate, as it is based upon the principal value of the bond. It may fluctuate up or down. Repayment at maturity is guaranteed by the US Government and may be adjusted for inflation to become the greater of the original face amount at issuance or that face amount plus an adjustment for inflation. Treasury Inflation-Protected Securities are guaranteed by the US Government, but inflation-protected bond funds do not provide such a guarantee.

Preferred securities are a type of hybrid investment that share characteristics of both stock and bonds. They are often callable, meaning the issuing company may redeem the security at a certain price after a certain date. Such call features, and the timing of a call, may affect the security’s yield. Preferred securities generally have lower credit ratings and a lower claim to assets than the issuer’s individual bonds. Like bonds, prices of preferred securities tend to move inversely with interest rates, so their prices may fall during periods of rising interest rates. Investment value will fluctuate, and preferred securities, when sold before maturity, may be worth more or less than original cost. Preferred securities are subject to various other risks including changes in interest rates and credit quality, default risks, market valuations, liquidity, prepayments, early redemption, deferral risk, corporate events, tax ramifications, and other factors.

Bank loans typically have below investment-grade credit ratings and may be subject to more credit risk, including the risk of nonpayment of principal or interest. Most bank loans have floating coupon rates that are tied to short-term reference rates like the Secured Overnight Financing Rate (SOFR), so substantial increases in interest rates may make it more difficult for issuers to service their debt and cause an increase in loan defaults. A rise in short-term references rates typically result in higher income payments for investors, however. Bank loans are typically secured by collateral posted by the issuer, or guarantees of its affiliates, the value of which may decline and be insufficient to cover repayment of the loan. Many loans are relatively illiquid or are subject to restrictions on resales, have delayed settlement periods, and may be difficult to value. Bank loans are also subject to maturity extension risk and prepayment risk.

Tax-exempt bonds are not necessarily a suitable investment for all persons. Information related to a security’s tax-exempt status (federal and in-state) is obtained from third parties, and does not guarantee its accuracy. Tax-exempt income may be subject to the Alternative Minimum Tax (AMT). Capital appreciation from bond funds and discounted bonds may be subject to state or local taxes. Capital gains are not exempt from federal income tax.

Currencies are speculative, very volatile and are not suitable for all investors.

The policy analysis provided by the Charles Schwab & Co., Inc., does not constitute and should not be interpreted as an endorsement of any political party.

Forecasts contained herein are for illustrative purposes only, may be based upon proprietary research and are developed through analysis of historical public data.

Schwab does not recommend the use of technical analysis as a sole means of investment research.

Indexes are unmanaged, do not incur management fees, costs, and expenses and cannot be invested in directly. For more information on indexes, please see schwab.com/indexdefinitions.

The Schwab Center for Financial Research is a division of Charles Schwab & Co., Inc.

Source: Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or ‘Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.